Main Menu

- Registry of Companies & Business Names

- Resources & Guides

- Frequently Asked Questions

- Revenue Division

- Resources & Guides

- Frequently Asked Questions

Resources & Guides

- Getting Started

- Registry of Companies and Business Names

- Revenue Division

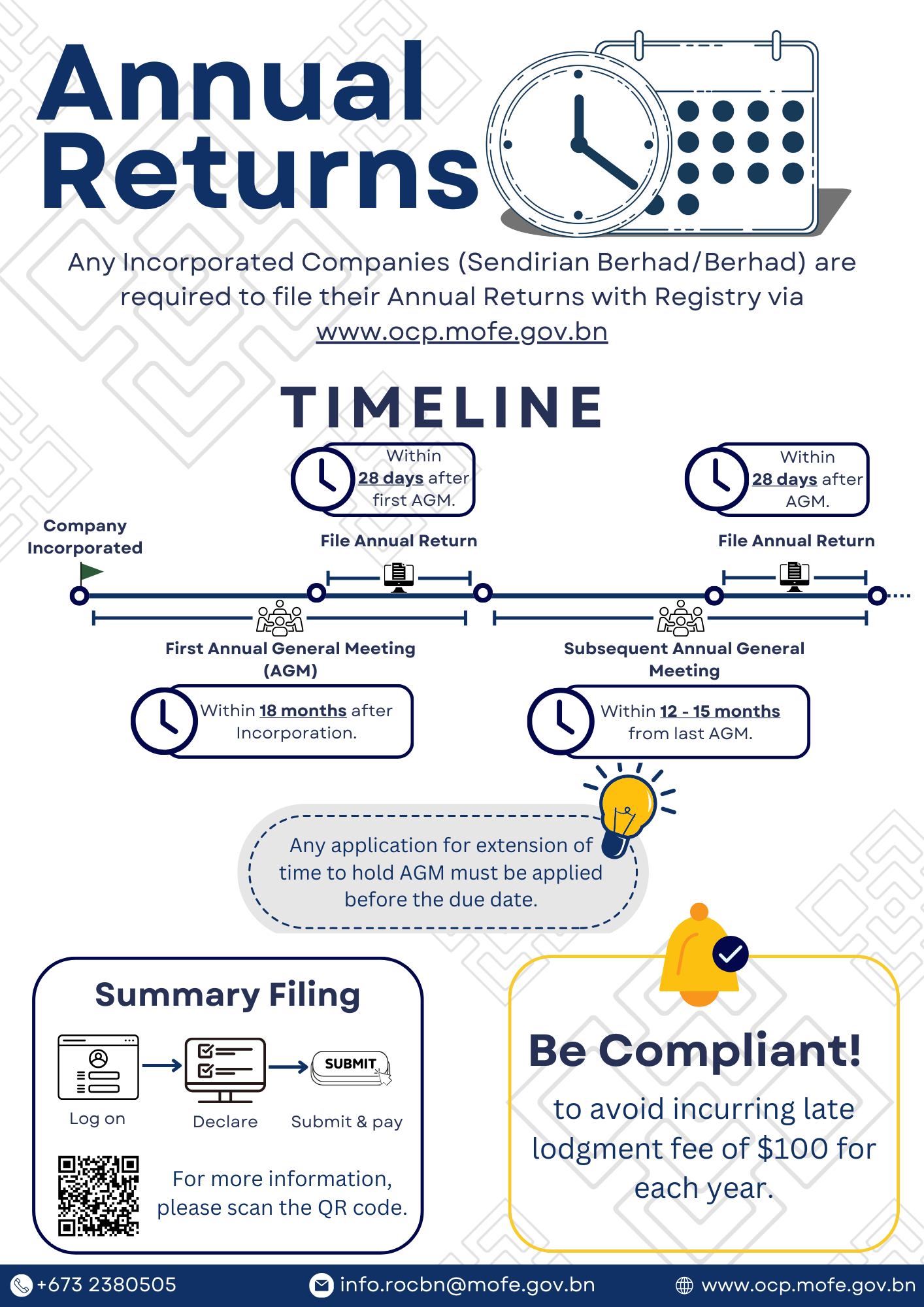

A company must file Annual Returns with the Registry of

Companies within 28 days after the Annual General Meeting

(AGM)

A company’s first AGM should be held within

18 months after incorporation.

Subsequent AGM’s must be held once every calendar year and

cannot be more than 15 months apart.

A company must appoint an auditor and have its accounts

audited. A company need not submit its audited accounts to the

Registrar of Companies. However, audited accounts are required

to be submitted to the Collector of Income Tax with its Income

Tax Returns.

What is the meaning of Dormant Company?

A company is considered dormant during a period in which no

accounting transaction occurs.

My company is dormant. Can a dormant company be exempted

from filing the Annual Returns?

NO. Every company is still

required to file its Annual Returns.

My company is dormant, does it still need to hold an AGM?

YES. an AGM must be held.

As the only local director of a company, am I allowed to

resign?

NO, the Companies Act requires

every company to have at least one director who is ordinarily

resident in Brunei Darussalam.

If I become bankrupt, must I resign?

YES.

What happens if the director(s) of a company becomes

bankrupt and there are no more directors left in the

company?

The shareholders have to appoint new director(s).

A company has two directors, one local and one foreigner. If

the foreign director cannot be contacted, will the local

director be held responsible for the company?

YES, Any person who consents to

act as director must discharge his duties as required under

the Companies Act.

If I am ignorant of the law and I consent my name being used

as a director to incorporate a company, will I be held

responsible for the company?

YES, A person who consents to

act as a director must discharge his duties as required under

the Companies Act. IGNORANCE OF THE LAW IS NO EXCUSE.

Can a ‘sleeping’ director be issued with a summons?

YES, The law does not give any

distinction between an “active” or a “sleeping” director. Any

person who consents to act as a director must discharge his

duties as required under the Companies Act. He is liable for

prosecution if he does not carry out his legal obligation

As the only local director of a company, am I allowed to

resign?

NO, the Companies Act requires

every company to have at least one director who is ordinarily

resident in Brunei Darussalam.

If I become bankrupt, must I resign?

YES.

What happens if the director(s) of a company becomes

bankrupt and there are no more directors left in the

company?

The shareholders have to appoint new director(s).

A company has two directors, one local and one foreigner. If

the foreign director cannot be contacted, will the local

director be held responsible for the company?

YES, Any person who consents to

act as director must discharge his duties as required under

the Companies Act.

If I am ignorant of the law and I consent my name being used

as a director to incorporate a company, will I be held

responsible for the company?

YES, A person who consents to

act as a director must discharge his duties as required under

the Companies Act. IGNORANCE OF THE LAW IS NO EXCUSE.

Can a ‘sleeping’ director be issued with a summons?

YES, The law does not give any

distinction between an “active” or a “sleeping” director. Any

person who consents to act as a director must discharge his

duties as required under the Companies Act. He is liable for

prosecution if he does not carry out his legal obligation.

All companies, whether previously registered under eRegistry or ROC System will be able to file their Annual Returns online via the One Common Portal (OCP).

| Step 01 | Log on to www.ocp.mofe.gov.bn and log in with your OCP account. |

| Step 02 | Under My Entities, click on the company for which Annual Returns are to be filed. |

| Step 03 | In the General Details page of your company |

| Step 04 | Click on the Registry button located on the top right of the page. |

| Step 05 | Click Annual Return. |

| Step 06 | Click File Annual Return. |

| Step 07 | Review your company details and click the checkboxes provided. |

| Step 08 | Select the AGM Date. |

| Step 09 | Upload supporting documents. |

| Step 10 | Click Submit. |

A yearly statement which contains information of a

company relating to its share capital, indebtedness,

directors, shareholders, changes in directorships,

corporate governance disclosures etc.

Filing of Annual returns yearly helps stakeholders to

ensure that the company is administered in a proper way

in the interest of its members and creditors.

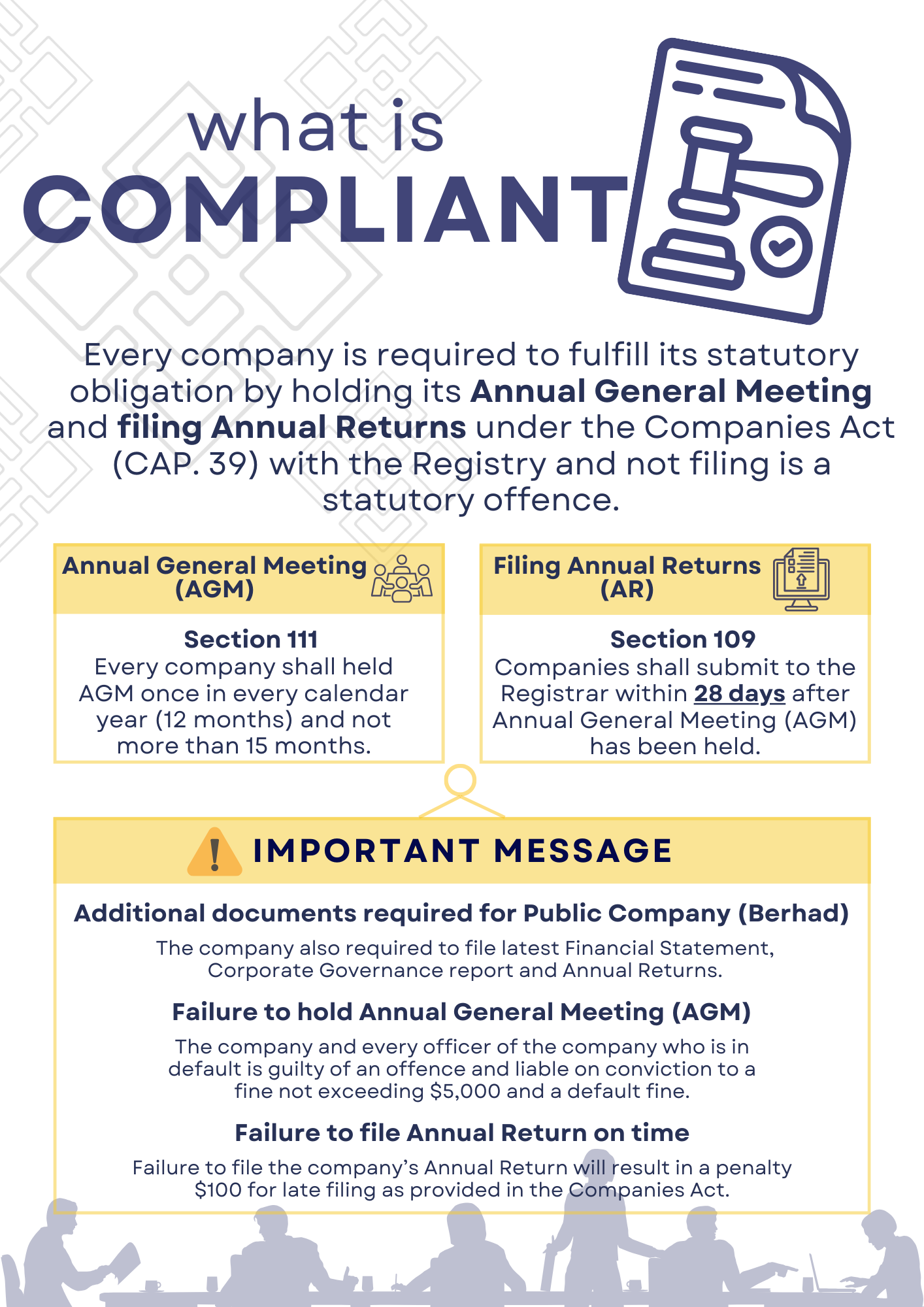

Under section 109 of the Companies Act, a company must

file their Annual Returns within 28 days from their

Annual General Meeting (AGM).

A company’s first AGM should be held within 18 months

after incorporation. Subsequent AGM’s should be held

once every calendar year and should not be more than 15

months apart.

The company’s officers (e.g. director or secretary) can file the AR. Alternatively, the company can engage the services of a professional firm or a corporate service provider to file the AR on its behalf.

- Cover Letter stating name of the public company and its registration number

- Annual Return form

- Date of AGM and proof

- Audited Financial Statements

The fee payable for filing the Annual Return for a local company is BND$50.00.

A company is considered ‘dormant’ during a period which

no accounting transaction occurs.

However, a ‘dormant’ company is still required to submit

their Annual Returns. It will also be subject to fees

payable to the Registrar and any fine/ default penalty

paid to the Registrar.

Please note that section 312 of the Companies Act

imposes a penalty for false statements made to the

Registrar.

Failure to file the company’s Annual Return will result

in a penalty for late lodgment as provided in the

Companies Act.

The company’s directors may also be issued a summon for

not complying with these provisions.

Yes, an application may be made to the Registrar via the

portal for an extension to hold an AGM. The extension

should be applied before your AGM deadline.

Company should provide the supporting documents stating

the reason and proposed date of extension. The extension

will then be reviewed by the Registry unit.

The fee for the extension is BND$200.

Click on this link for the guide on how to request for

an extension for AR or AGM.

Yes. Annual Returns can be file online via the Portal.

Please refer to Resources and Guides section for steps

to filing your annual returns.

Pursuant to section 302(3) of the Companies Act, a company incorporated outside Brunei Darussalam shall within 2 months of its AGM, lodge with the Registrar, a copy of its balance sheet made up to the end of its last financial year.

Are you looking for help?

Other Links

Ministry of Finance and Economy website

E-Amanah

One Common Billing system

Treasury Accounting and Financial Information System (TAFIS)

Brunei E-Customs

Brunei Darussalam National Single Window (BDSNW)

Trading Across Borders

Brunei Darussalam National Trade Depository

Brunei Darussalam Accounting Standard Council (BDASC)

Copyright (c) 2025 Ministry of Finance and Economy, Brunei Darussalam. All Rights Reserved.