Main Menu

- Registry of Companies & Business Names

- Resources & Guides

- Frequently Asked Questions

- Revenue Division

- Resources & Guides

- Frequently Asked Questions

News & Announcements

REMINDER: Please ensure that your Corporate Income Tax Return for the Year of Assessment 2025 is submitted via One Common Portal (OCP) on or before 30 June 2025.

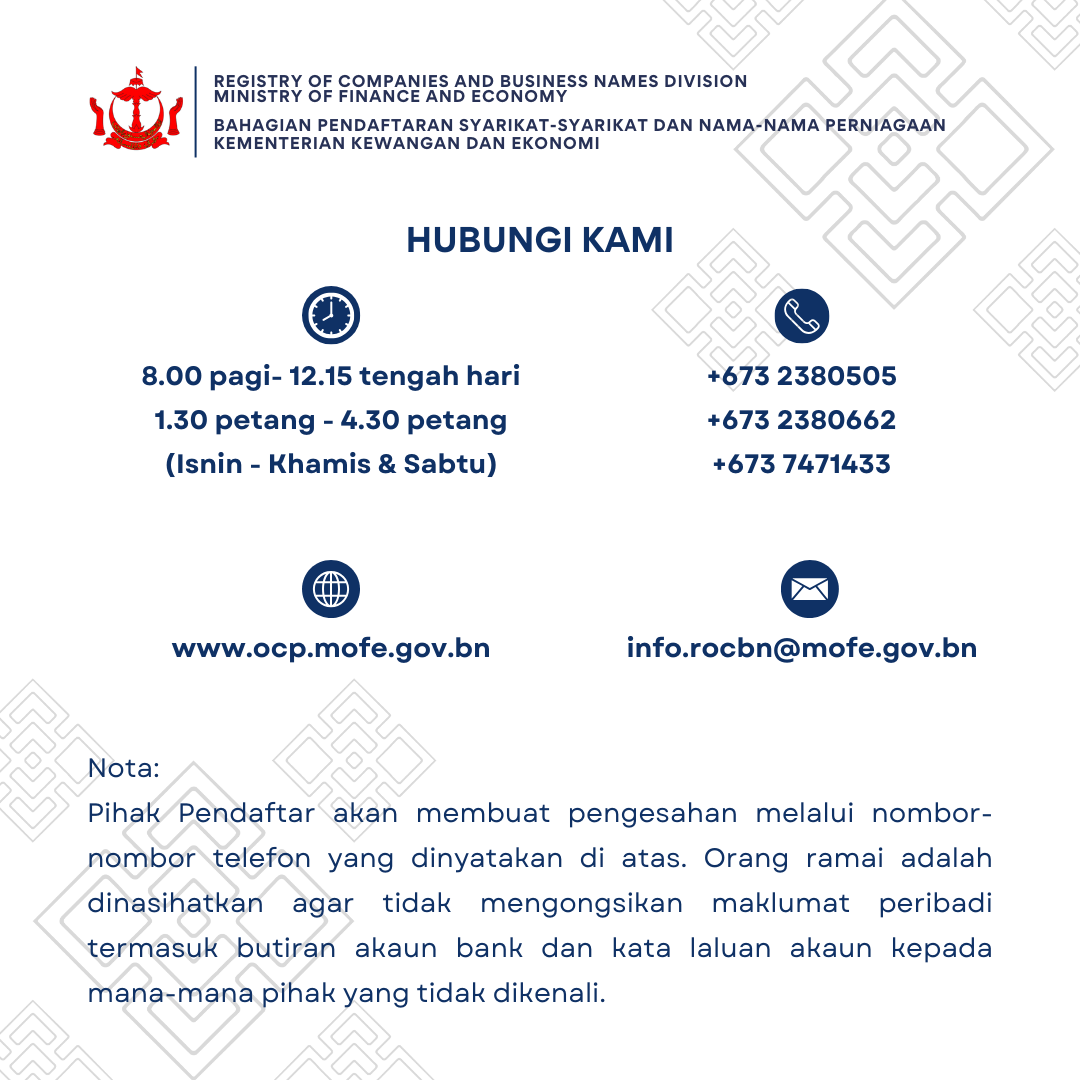

The Registry of Companies and Business Names Division (ROCBN), Ministry of Finance and Economy would like to inform the public that the contact information are updated as follows:

Are you looking for help?

Other Links

Ministry of Finance and Economy website

E-Amanah

One Common Billing system

Treasury Accounting and Financial Information System (TAFIS)

Brunei E-Customs

Brunei Darussalam National Single Window (BDSNW)

Trading Across Borders

Brunei Darussalam National Trade Depository

Brunei Darussalam Accounting Standard Council (BDASC)

Copyright (c) 2025 Ministry of Finance and Economy, Brunei Darussalam. All Rights Reserved.